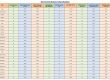

Distressed U.S. office properties have lost more than half their value, threatening billions in losses for commercial mortgage investors, according to a CoStar analysis of 270 specially serviced loans in commercial mortgage-backed securities deals that have been reappraised in the past 12 months.

The scale of distress, $19.2 billion in troubled debt backed by only $16.6 billion in collateral value, leaves lenders facing difficult choices between extending loans or realizing substantial losses through foreclosure and liquidation.

That collateral value represents a loss of $18 billion from the $34.6 billion in value the properties were appraised at when the loans were originated. On average, the properties saw new appraisals come in 52% lower. More than half the properties lost over 50% of their value, and 29 properties declined more than 80% in value.

The value destruction has pushed many loans deeply underwater. Over 70% now carry loan-to-value ratios exceeding 100%, meaning the debt surpasses the property value. The average loan-to-value stands at 167%.

Plummeting occupancy is the main driver of the situation, analysts have said, a result of office tenants trading up to better serviced, updated properties and shunning those that have not been invested in.

The analysis showed properties that lost 40 or more occupancy points saw values plummet 62%.

The elevated vacancies serve as a reminder of the pain still present even as office demand turned a corner in the third quarter. About 12 million more square feet of space was occupied than given up, the first positive quarterly figure since late 2021.

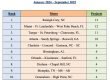

The troubled CMBS debt was primarily originated before the pandemic, with the heaviest concentrations from 2014-2015 deals totaling 130 loans valued at $6.9 billion.

This trend continues to flush out. We have been advising our corporate clients of this for the last several years. We expect it to continue for the next 24 months or so. More important than ever to select the right building and landlord and demand in depth due diligence before signing a lease. As space users continue to gravitate toward better buildings, the best properties will maintain/increase pricing power. Interesting times ahead!