For the first time in 15 years, U.S. logistics tenants have vacated more space than they moved into during a given quarter, a phenomenon that was driven by businesses slowing expansion plans over the past year in the face of deteriorating consumer confidence and uncertainty over global trade as well as new speculative build deliveries worldwide that were started when demand was at peak. Overall, this was expected and is a normal supply/demand occurrence, just like the office market has rebounded with the best properties in short supply and also enjoying upward pricing pressure.

A clear indicator of this slowdown has been a moderation in retailer inventory growth, a data point that has remained flat since late 2024, according to the Federal Reserve Bank of St. Louis.

The slowdown in inventory growth has affected logistics demand, and the second quarter of 2025 closed with about 20 million square feet of negative net absorption — the first quarter with negative absorption since 2010. Logistics properties are commercial buildings designed for the storage, handling and distribution of goods.

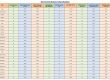

For now, the bulk of softer demand has been concentrated in larger and older properties. Properties larger than 200,000 square feet and built before 2010 saw more than 32 million square feet of occupancy loss this past quarter, according to CoStar data. However, this will likely spread to all properties as space users digest what they took in countered by normalized (lighter) client demand.

Properties of the same vintage, between 50,000 square feet and 199,000 square feet, saw over 18 million square feet of net move-outs.

While smaller properties, those less than 50,000 square feet, also saw occupancy losses in older vintages, these were more moderate at less than 6 million square feet.

In contrast, newer properties built since 2010 have continued to see positive absorption, or more space occupied than vacated in a given period. However, even for the newest properties, net absorption has edged lower.

Years of supply, calculated by dividing available inventory by the sum of net absorption in the prior four quarters, has continued to trend upward, with larger properties exhibiting the highest supply risk.

While smaller properties continue to see lower years of supply, this metric has also moved higher for the segment below 50,000 square feet. Years of supply for smaller properties now stands at about two years, up from less than 1 1/2 years in the third quarter of 2024.

Despite a slowdown in construction that has eased concerns about a continued supply wave, slower net absorption is now becoming an obstacle to a recovery in logistics market performance. Quarterly net absorption relative to the average of the prior year has fallen between 28% and over 60% across all size segments of properties built since June 2020.

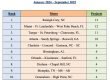

Cooling demand is also broad-based across geographies. Large logistics markets such as the Inland Empire and the East Bay in California, as well as Los Angeles, Seattle, Chicago, Atlanta, Baltimore and Harrisburg, Pennsylvania, are driving the bulk of negative absorption so far this quarter.

That said, 30 out of the largest 50 logistics markets and over half of all U.S. markets tracked by CoStar saw negative net absorption in the second quarter of 2025.

Continued economic uncertainty will likely drive softer logistics demand readings relative to what has been seen in prior years, CoStar projects. This moderation in demand, despite a waning supply wave, should delay a reacceleration in rent growth as vacancies take longer to turn the corner.