The commercial real estate debt market is entering a pivotal period, where 10-year loans issued in 2016 are facing maturity with valuations well below their original underwriting.

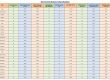

More than $100 billion in CMBS loans are set to mature in 2026, with analysts expecting over half to miss their repayment deadlines.

The wave of distressed debt provides a window into whether recent improvements in refinancing conditions can withstand the headwinds caused by elevated interest rates and lower property values.

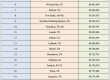

Lenders continue to demand higher debt service coverage ratios and lower loan-to-value ratios, creating refinancing gaps of 20% to 30% for some property types.

The upside, though, is that the market is coming off a year of improving payoff rates.

Nearly 90% of CMBS loans that matured in 2025 were successfully paid off, marking a notable improvement from the previous year and offering cautious optimism for the challenges ahead.

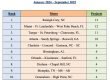

The payoff-rate-by-loan-count reached 89.8% in 2025, up from 85.6% in 2024, according to research from KBRA and Morningstar DBRS. The improvement proved even more pronounced when measured by loan balance, jumping to 74.3% from 66.6% the prior year.

Office properties drove much of the improvement, despite remaining the weakest-performing sector, with payoff rates climbing to 70.1% by loan count and 58.3% by balance. Industrial properties maintain the strongest position for refinancing, buoyed by sustained demand for logistics and distribution space, according to KBRA and Morningstar DBRS data.

Multifamily properties face moderating rent growth but benefit from underlying housing demand, the bond rating firms said. Retail properties are finding ways to coexist with e-commerce. Hotels show pockets of stress alongside stable performance in key markets.

KBRA and Morningstar DBRS expect downgrades to outpace upgrades in 2026.

“Will be really interesting to see how this plays out. Corporate clients/tenants will need expert guidance to both leverage the opportunities and avoid the pitfalls.”